One of the driving factors in calculating property taxes is assessed value. As property values increased across the state – especially during the Bakken Oil Boom – so have property tax bills. While reading the minutes of the most recent meeting for the interim Education Funding Committee, I came across a staggering figure relating to taxable valuations in the Tioga School District:

“Senator Rust provided information (Appendix H) regarding the taxable valuation of the Tioga School District. He said taxable valuation in the district has grown from $6.3 million in 2009, to $69 million in 2017. He said the school district deposits tax revenue in various funds, including the general fund. He said in the Tioga School District, 68 percent of property tax collections are deposited in the general fund, but gross production tax allocations are offset at 75 percent in the state school aid formula. He said the nine largest oil-producing counties in the state allocate an average of 65 percent of their property taxes to the general fund. He said gross production tax allocations are offset in the state school aid formula as if it is only deposited in the general fund.”

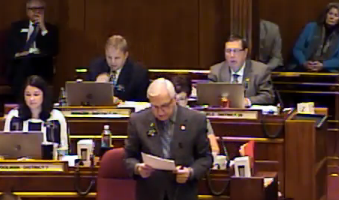

According to the North Dakota Legislative Branch website, not only is Senator David Rust (R – District 2) a member of the Education Funding Committee, but he’s also the former Superintendent of Schools in Tioga– also known as the “Oil Capital of North Dakota“. I suppose this is the reason he pulled the Tioga School District’s information for use in the committee meeting.

The growth of Tioga’s taxable valuations represents an increase of over 995% in the space of just eight years! Now, to be fair, I recognize that this school district rests in oil country, which undoubtedly resulted in growth. For example, in 2009, enrollment was 261 students. Compare that to 2017 where enrollment was 433– a 65.9% increase. The population of Tioga in 2009 was 1,127 and 1,547 in 2016 (the latest data)–a 37.2% increase.

I won’t pretend to know all the reasons for such an astronomical increase to taxable valuations. What I do know is this… the overall increase seems to have significantly outpaced the growth– by a long shot. With increases like this, is it any wonder people are upset across the state?

What these figures demonstrate is what any sensible person realized long ago… property taxes are, as a very good political friend of mine put it, the most “arbitrary” and “capricious” taxes that exist. They are “determined only by the government’s appetite” and are almost exclusively disconnected from a person’s ability to pay.

Earlier this month, we published an article documenting the fact that the North Dakota Department of Public Instruction admits the state’s portion of K-12 education:

“… provides a base of financial support per student sufficient to provide an adequate education by school districts, regardless of where the student lives or what the taxable valuation is of the district.”

Property taxes are a gravy train for education. The state should be meeting its constitutional obligation to fully fund K-12.

I wonder what the percentage of increases to taxable valuations has been in the other school districts throughout the state? For now, I’m not sure. But one thing is for sure… taxpayers in the Tioga School District have every right to be unhappy.

Let us know if you’re aware of the percentage of increases in your district.

Sources:

- https://www.investopedia.com/articles/tax/09/calculate-property-tax.asp

- http://www.legis.nd.gov/assembly/65-2017/interim/19-5095-03000-meeting-minutes.pdf

- http://www.legis.nd.gov/files/committees/65-2017/19_5095_03000appendixh.pdf

- http://www.legis.nd.gov/assembly/65-2017/members/senate/senator-david-s-rust

- http://tioga.govoffice2.com/?pri=0&tri=305

- https://www.nd.gov/dpi/SchoolStaff/SchoolFinance/Resources/

- https://www.google.com/search?safe=strict&source=hp&ei=D4WXWrOHM4LwsAXi2Ihw&q=Population+of+Tioga+ND&oq=Population+of+Tioga+ND&gs_l=psy-ab.3..0.453.5629.0.5933.27.22.2.0.0.0.240.2632.2j14j3.19.0..2..0…1.1.64.psy-ab..6.21.2688.0..35i39k1j0i131k1j0i20i264k1j0i67k1j0i131i20i264k1j0i131i46i67k1j46i131i67k1j0i20i263i264k1j0i131i67k1j0i22i30k1.0.h0lzR_jfvzg

- https://theminutemanblog.com/2018/02/05/documents-say-state-funding-of-k-12-adequate-without-property-tax/

- https://www.nd.gov/dpi/uploads/146/StateAidFormulav2.pdf

- https://www.nd.gov/dpi/uploads/146/StateAidFormulav2.pdf

- https://theminutemanblog.com/2017/12/28/is-property-tax-an-unconstitutional-funding-mechanism-for-education/