A recent letter to the editor from Sen. Rich Wardner and Rep. Al Carlson was dismaying to say the least. It contained a number of troubling inaccuracies.

These Senate and House leaders stated, “Property taxes are necessary to fund local schools.” This is absolutely inaccurate. Our state constitution clearly states funding public schools is the responsibility of the state, not local political sub divisions. It also states that the state is not permitted to use property taxes to fund anything other than 1 mill for support of a state hospital.

Further, the state is sitting on more than $3.6 billion dollars in the School Lands Trust money. 98-plus percent of which is invested in Wall Street assets. As of 6/30/16 not a dime was invested in North Dakota public schools. As of 3/31/17 more than $624 million was invested in national real estate ventures – none in our school buildings.

Wardner and Carlson tell us property taxes are needed to fund most infrastructure. This is not true. Roads, water, sewer, garbage and the like should properly be funded with user fees. Gas tax is actually a user fee. User fees are the appropriate way to fund roads and infrastructure.

Wardner and Carlson tell us the state has little, if any, control over property taxes. This is also untrue. Just ask any county councilman. The state has a property tax manual – it’s 27 pages long – and lists virtually everything imaginable. In order for local jurisdictions to receive state funds (from state sales, income tax and other state revenue) they must impose state mandated mills as a condition. I believe that might be considered control.

Wardner and Carlson went on to describe how many billions the state has spent since 2007 to reduce your property taxes. Then they noted, “We quickly realized (in 2009) that in the absence of any real control over local spending, tax rates, or valuation increases the state was on an unsustainable course.” What they didn’t tell you was how many billions (more than $4 billion), over the last ten years, they appropriated and spent to subsidize the college education of non-resident students whose parents pay no North Dakota taxes.

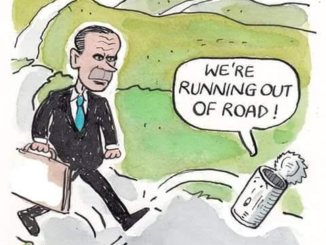

Fellow taxpayer, this is the truth. Government is out of control and what it is doing is unsustainable – EXCEPT – it isn’t. Regardless of what Wardner and Carlson say, your taxes are going to continue to go up and up and up. This is directly the result of their mismanagement.

Property taxes are political leaders’ ace in the hole. And that’s why government loves property taxes. People will pay their property taxes no matter how painful. Why? Because failure to do so results in the Sheriff selling your house and putting you and your family on the street or in government subsidized housing – which, of course, government controls.

Wardner and Carlson spouted their confusing numbers and assertions claiming the Legislature tackled property tax relief. It was all smoke and mirrors – there was never any actual “property tax relief.” Funding schools is not property tax relief. It is a constitutional mandate and using property taxes to meet this state obligation conflicts with our constitution’s mandate to the state.

The School Lands Trust is sitting on $3.5 billion of public school money – invested in Wall Street – not our schools. This fund is growing by hundreds of millions annually. Yet, virtually all is invested in Wall Street. Not a very safe place at the moment, by the way.

During the 2006 downturn our Wall Street investments lost almost 40% of their value. Be prepared. Such a repeat is more likely than not to occur again. So much for responsible fiscal management.

With straight faces, Wardner and Carlson tell us, “No gimmicks, no funny numbers, just the facts that show our real commitment to property tax relief, even during difficult times.” Humm… “Even during difficult times.” These leaders led a spending spree, over the last ten years, that defies logic and good management. They burned through billions with no let up in taxes. Taxpayers received virtually none of the billions in windfall revenue from oil and gas.

They funded infrastructure with ‘one time spending.’ This guaranteed that we would get no tax relief. It was foolish because infrastructure is appropriately funded with long-term debt.

Jurisdiction after jurisdiction increased local option sales taxes. Today, North Dakota’s average sales tax has jumped from 5 percent to 7.5 percent. That’s a 50 percent increase. Income taxes have not abated. Property taxes are higher today than ever.

These political leaders have the gall to tell us, “While painful, we encourage local elected officials to make spending cuts before increasing property taxes.” When our oil windfall came these same individuals spent like drunken sailors. Instead of lowering taxes they refused. They took billions in oil revenue, washed it through what they call the Strategic Investment and Improvement Fund and foolishly spent it on what they called – ‘one time spending.’ Thus, no tax relief for us.

The fact is there is only one way to reduce our tax burden. That is to take away some of government’s sources of revenue. The only way to keep us secure in our home and not have to rent our own homes from government is to eliminate government’s ability to tax our homes.

What spending can be cut? Maybe we start by looking at the more than $3.6 billion we spend in North Dakota on welfare. According to recent reports our state has the lowest unemployment rate in the nation. North Dakota spends more on welfare than all K-12 and Higher Ed combined. Since 2005 welfare spending has gone from $1.5 billion to $3.6 billion per biennium.

It’s time to care for our families and home security. Tell our elected officials they need to do the “painful” job they are elected to do and cut the size and cost of government. It’s time they represent those of us who work and pay taxes, not special interests.

I, for one, am tired of these officials playing games with gimmicks, funny numbers, convoluted excuses and fake facts.

Maybe it’s time we assert ourselves and take our government back. A good start might be to take away the property tax power. Clearly, our elected officials have lost control and no longer deserve to continue holding our homes hostage to their mismanagement.

Robert (Bob) L. Hale is an attorney, an entrepreneur, a builder/developer, and is the founder of the Northwest Legal Foundation. Mr. Hale has a B.A. in Business Administration and a minor in Sociology from the University of Washington (Seattle) and a J.D. from Gonzaga University Law School in Spokane, Washington. He resides in Minot, North Dakota.

**NOTE: This article originally appeared in the Minot Daily News on October 8, 2017.**

Sources:

1. http://www.minotdailynews.com/opinion/letters/2017/10/gimmicks-funny-numbers-and-fake-facts/

2. http://www.fgfbooks.com/Hale/Hale-bio.html

3. http://www.minotdailynews.com/opinion/community-columnists/2017/09/property-tax-relief-was-increased-in-2017-session/